Payment of a W/C - CSST Compensation

OBJECTIVE

When a work accident occurs, the employer must pay compensation to an employee for the days during which the employee would normally have worked, during the time the W/C - CSST is handling his case. The Commission de la santé et de la sécurité au travail (CSST) will subsequently reimburse the employer.

This document deals only with the payment of compensation by W/C - CSST.

PREREQUISITE

PROCEDURE

Take the example of an employee who is seriously injured during the day on Wednesday and is not expected to return in the coming days. You must enter the employee's hours for the two days worked (Monday and Tuesday). In Québec, you must pay 90% of the employee's net salary, taking into consideration the maximum insurable amount with the W/C - CSST for the days on which he would have normally worked.

If there is an accident at work, you must perform the following three steps in maestro*:

- Report the accident in Manage Events (optional)

- Pay the W/C - CSST compensation during the period that the employee's case is being handled by W/C - CSST

- Cash the W/C - CSST refund

Report the accident by keeping track of the event (optional)

This step is optional in maestro*. This consists of keeping track of the events that occurred during an accident, that relate to your employee, by entering this information using the Manage Events option.

- This option is available in the main maestro* window. Click the Time Management module, and then Human Resources in the menu on the left.

- In the section on the right, in the Events Management group, click Manage Events.

For more information on this option, refer to the Manage Events help topic.

Pay W/C - CSST compensation to an employee and process the refund from W/C - CSST

There are two methods for paying W/C - CSST compensation to the employee in maestro*.

The user must make a choice depending on their requirements. Click on a hyperlink to access one of these methods:

|

Method Used |

Description |

|---|---|

|

Method 1: Pay the W/C CSST compensation to an employee using an expense reimbursement bonus |

|

|

Method 2: Pay compensation to an employee by preparing a personal cheque |

|

Method 1: Pay the employee using an "Expense Reimbursement" bonus

This method allows the user to issue a single payment to the employee that includes the actual hours worked and the amount that represents 90% of the net salary for a work accident in Québec, if applicable.

Prerequisite

- You must know the amount payable to the employee (in Québec, this amount represents 90% of his net salary, taking the maximum insurable W/C - CSST amount into consideration).

- Have a "W/C - CSST receivable" general ledger account.

- Have an asset project with a W/C - CSST receivable activity that points to the "W/C - CSST receivable" general ledger account.

- Have an Expense Reimbursement bonus/deduction linked to the W/C - CSST activity.

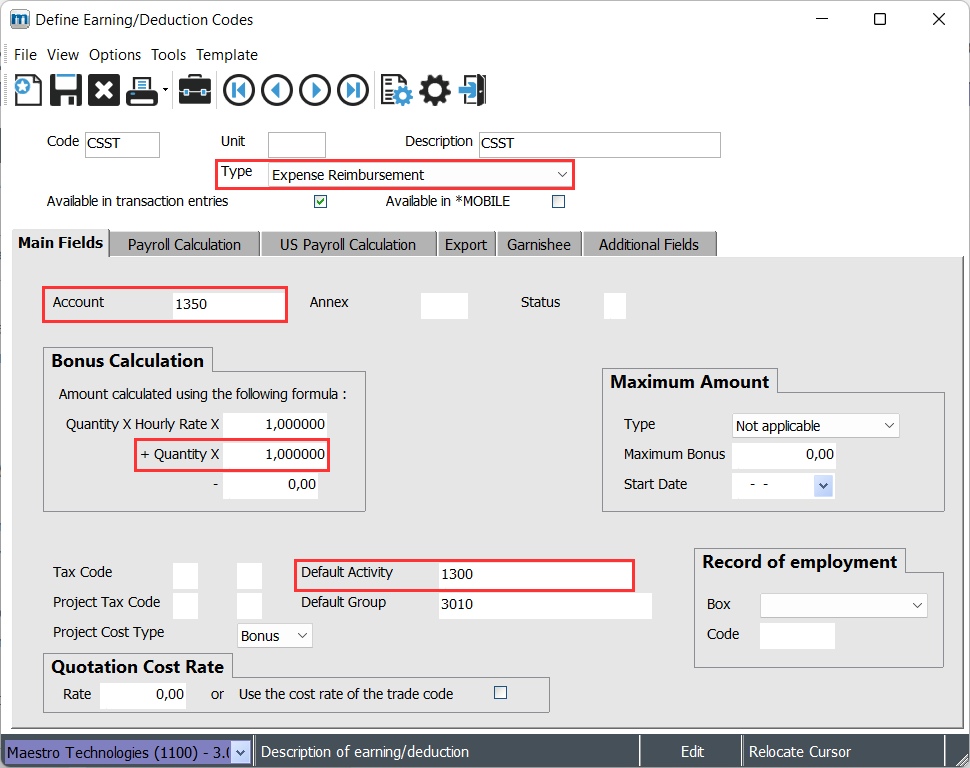

Step 1: Create an Expense Reimbursement bonus/deduction

|

maestro* > Time Management > Maintenance > Payroll > Define Earning/Deduction Codes |

- Create the bonus paying particular attention to the fields listed in the table below:

Field

Select / Enter

Type

Expense Reimbursement

Account

Enter the "Accrued expense" account if you are using payroll reconciliation. Otherwise, use the W/C - CSST receivable account.

Hourly Rate

Enter a rate of 1.000000 to ensure that the amount equals the amount payable entered in time entry, which is multiplied by this number.

Default Activity

Enter the activity that represents the W/C - CSST receivable in the asset project.

- Click Save and Exit.

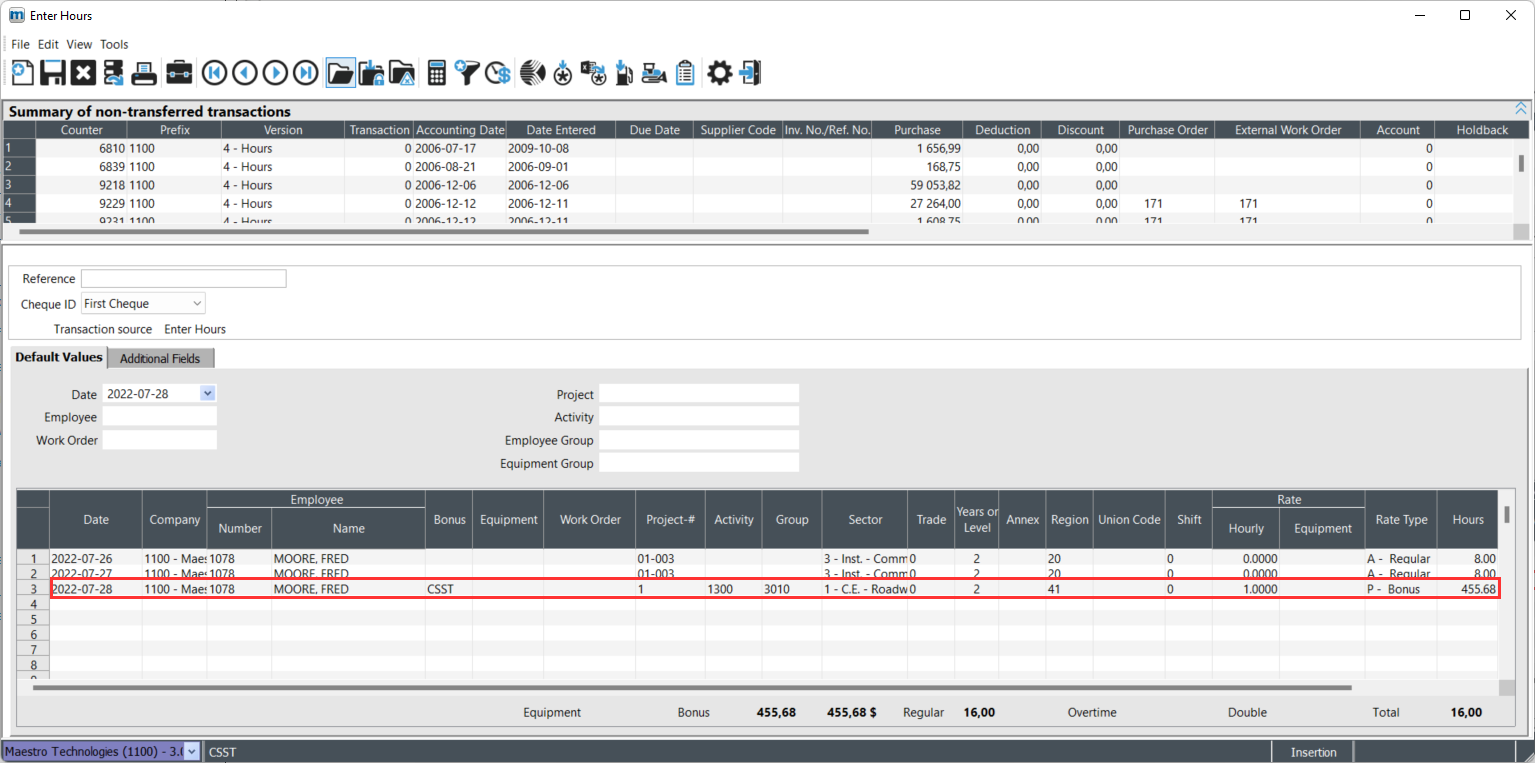

Step 2: Start entering the hours in projects

At this stage, you will enter the hours actually worked on projects for the days Monday and Tuesday in our example. The hours to be filled and reimbursed by the W/C-CSST will be entered in the balance sheet project using the bonus created in step 1.

|

maestro* > Time Management > Project Time > Processing > Enter Hours |

- Enter the hours by entering the following information on separate lines:

Types of hours or Bonus

Actions

Actual Hours Worked

Enter the time actually worked on projects.

Amount representing the hours to be filled following a work accident

Enter using a bonus (for example, W/C CSST), the amount representing the hours to be filled in the balance sheet project.

This amount must be entered in the Hours column and the activity linked to the G/L account (W/C CSST receivable) must be selected.

- Save the hours and complete the payroll process.

Method 2: Pay compensation to an employee by preparing an individual cheque

This method, which is the simplest, involves only the financial aspect and has no connection with the payroll module or projects.

It makes it possible to issue a cheque to an employee (without a bank deposit) through a direct disbursement. When the amounts due from the W/C CSST are received, the user must enter an individual receipt in the general ledger account specified in the direct disbursement.

Prerequisite

- Have a "W/C - CSST receivable" general ledger account.

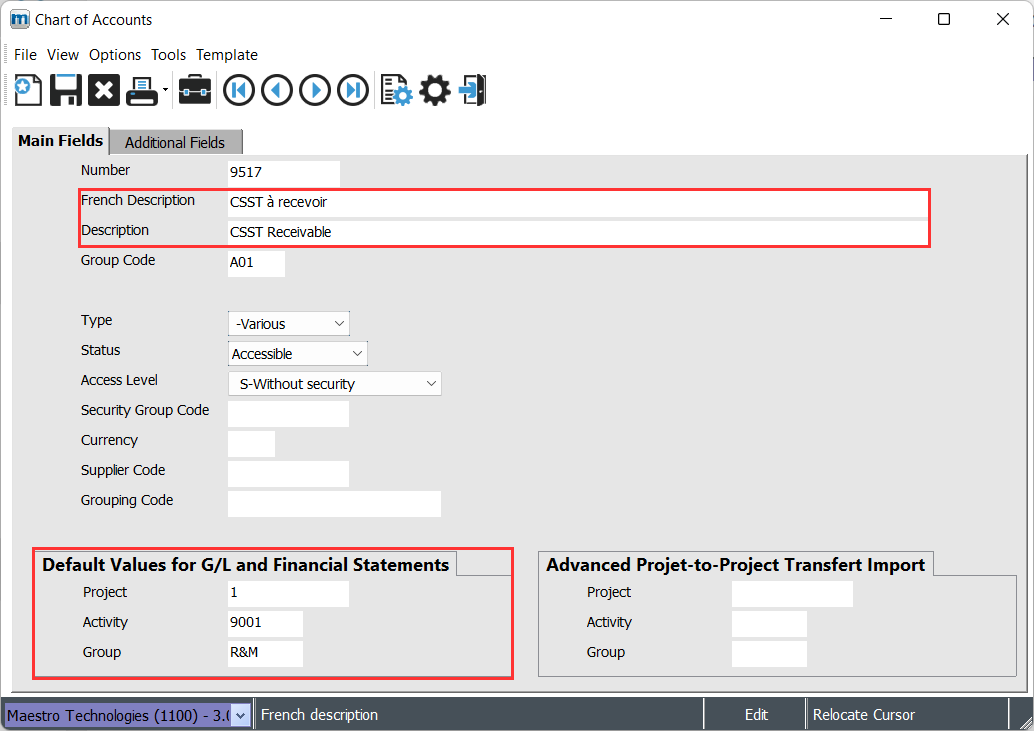

Step 1: Create a "W/C - CSST receivable" general ledger account

This step is required if the "W/C - CSST receivable" general ledger account does not exist in your chart of accounts or if you prepare financial statements by projects.

|

maestro* > Accounting > Maintenance > Accounting > Chart of Accounts |

- Create the "W/C - CSST receivable" account specifying the Default values for the G/L and financial statements section if you print financial statements by project to link the individual receipt transaction or direct disbursement to the asset project.

- Click Save and Quit.

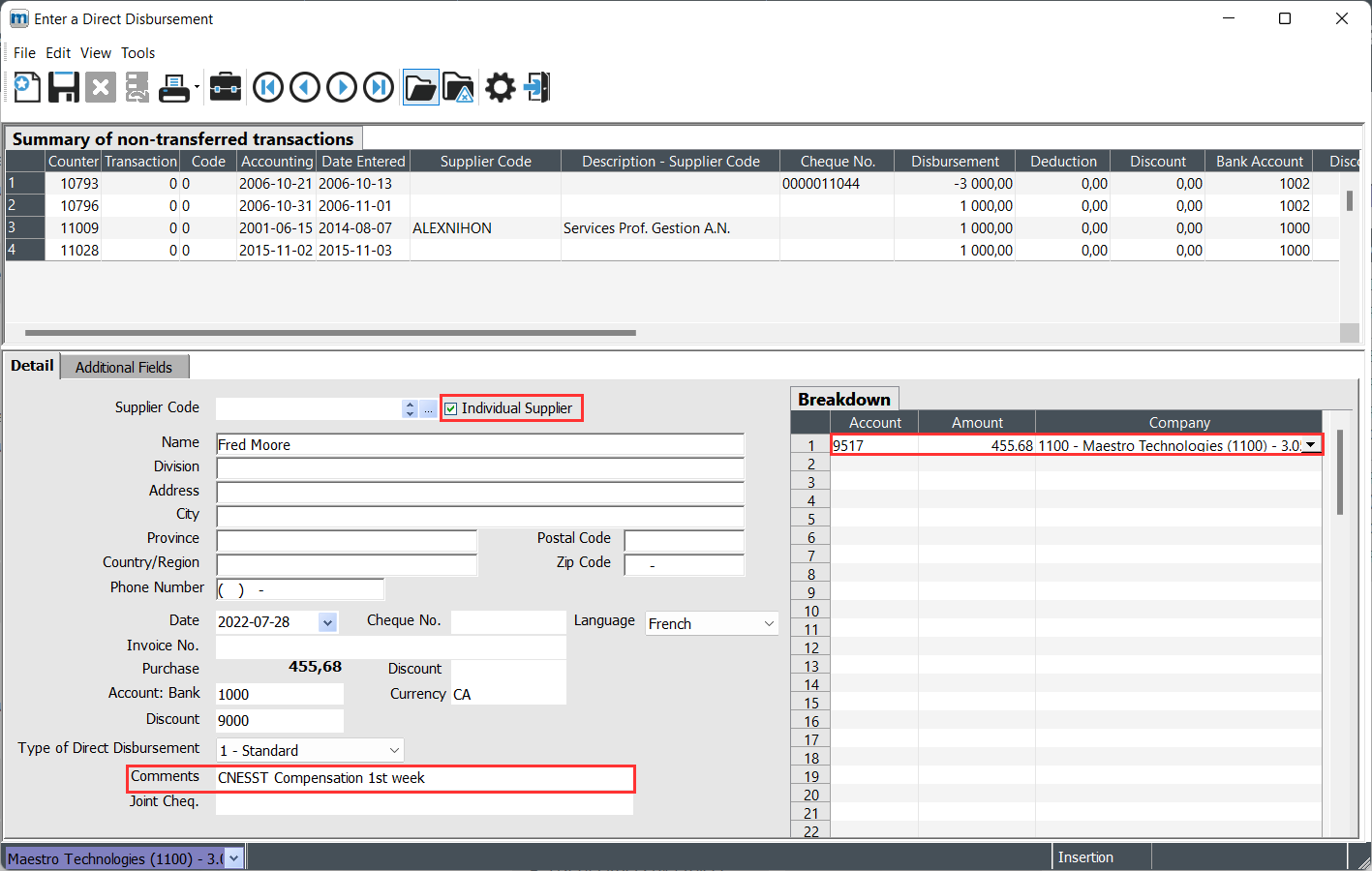

Step 2: Make the compensation payment to the employee while his case is being handled by the W/C - CSST

This step involves paying compensation to the employee in accordance with the agreement with the W/C - CSST in your province, for days on which he would normally have worked. No entries are required in time entry.

|

maestro* > Purchasing > Purchasing > Payments > Enter a Direct Disbursement |

- Complete the disbursement paying particular attention to the following fields:

Fields/Tab

Enter/Select

Supp. Individual

Check this field and complete the information for the employee.

Breakdown

Select the "W/C CSST receivable" account

Enter the amount of compensation payable to the employee.

Type of Direct Disbursement

1 – Standard

Comments

Enter a comment.

- Click Save and then transfer the disbursement.

- Print the compensation by accessing the Print Cheques option.

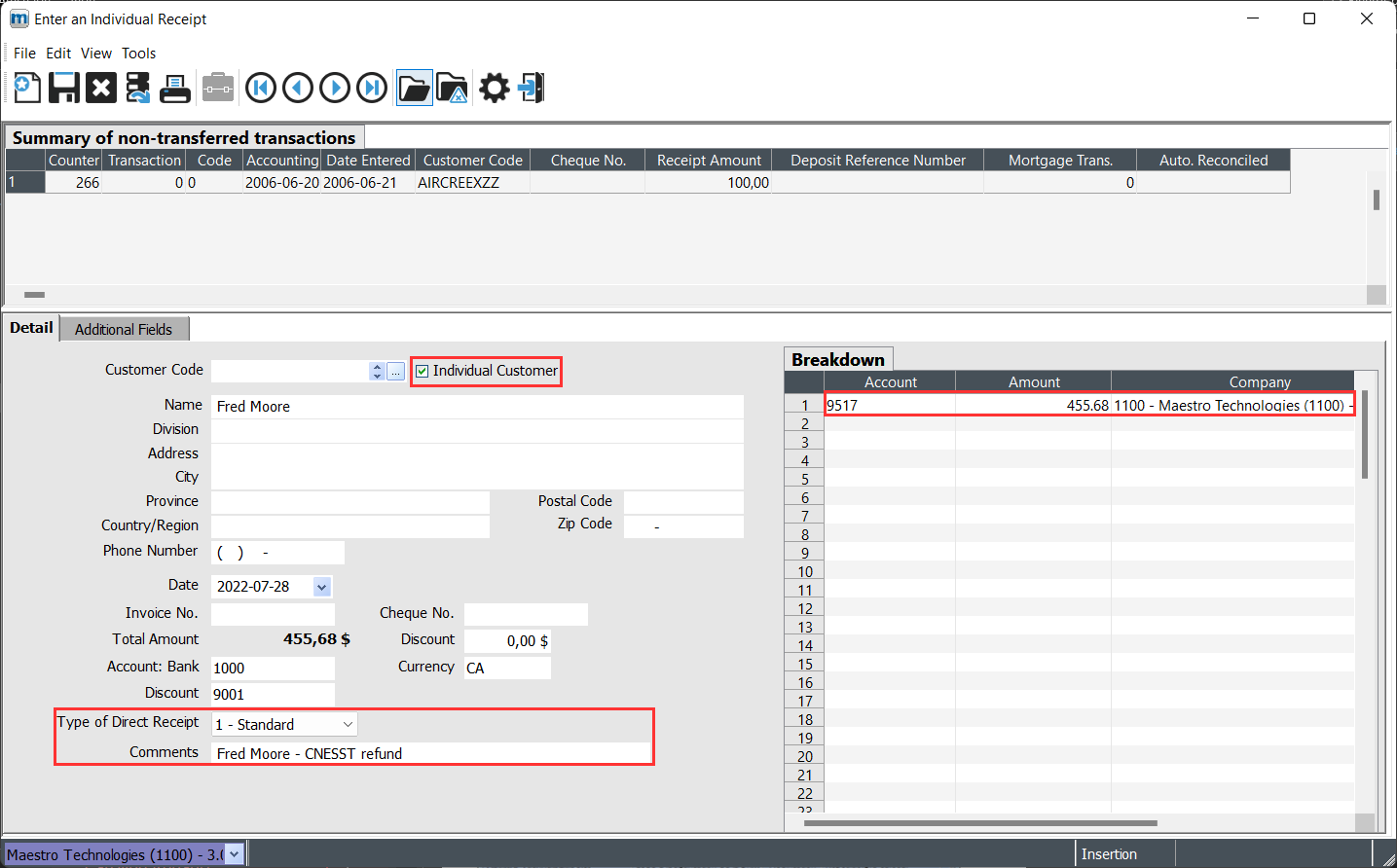

Cash the W/C CSST refund

When the W/C CSST refund cheque is received, an individual recipe must be entered specifying the general ledger account specified in the activity used when entering hours.

|

maestro* > Invoicing > Invoicing > Receipts > Enter an Individual Receipt |

- Complete the individual receipt paying particular attention to the following fields:

Fields/Tab

Enter/Select

Individual Customer

Check this field and complete the W/C CSST information.

Breakdown

Select the "W/C CSST receivable" account

Enter the amount of the compensation refund.

Type of Direct Receipt

1 – Standard

Comments

Enter a comment.

- Click Save and then transfer the receipt.

See also

- Employee Management

- Enter Hours

- Chart of Accounts

- Enter a Direct Disbursement

- Enter an Individual Receipt